The EIB Board of Directors approved €7.7bn of financing for 40 projects to enhance private sector #accesstofinance, strengthen #SustainableTransport, increase #CleanEnergy use & accelerate priority investment in cities across Europe & around

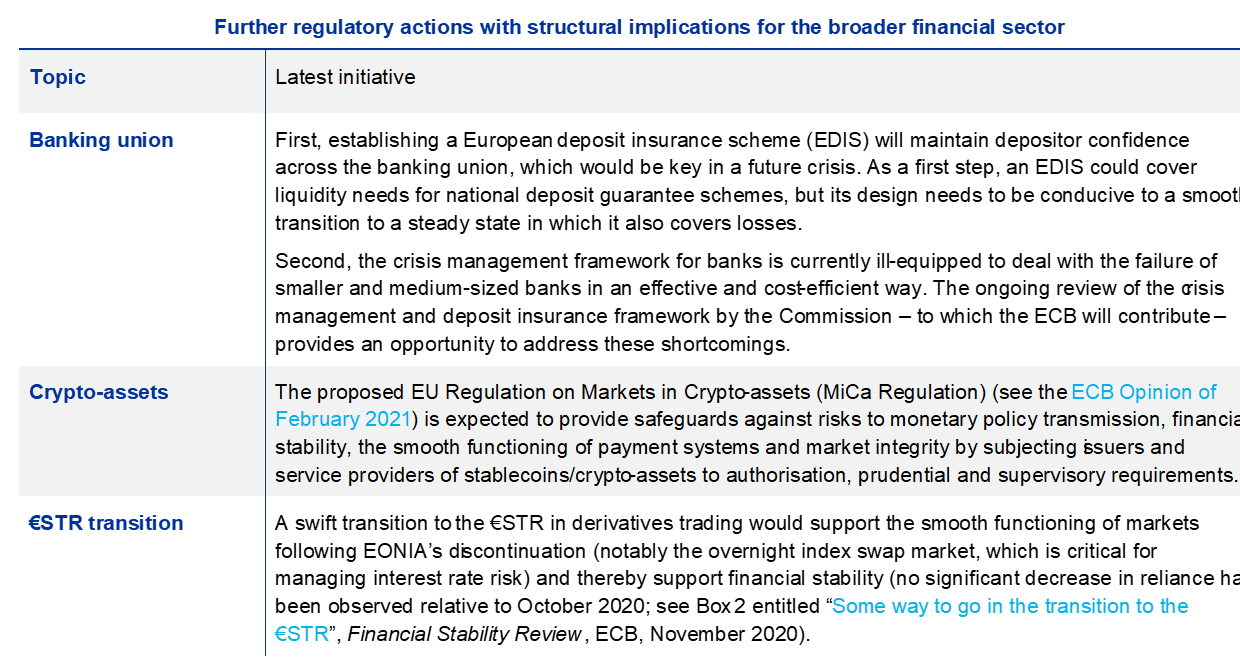

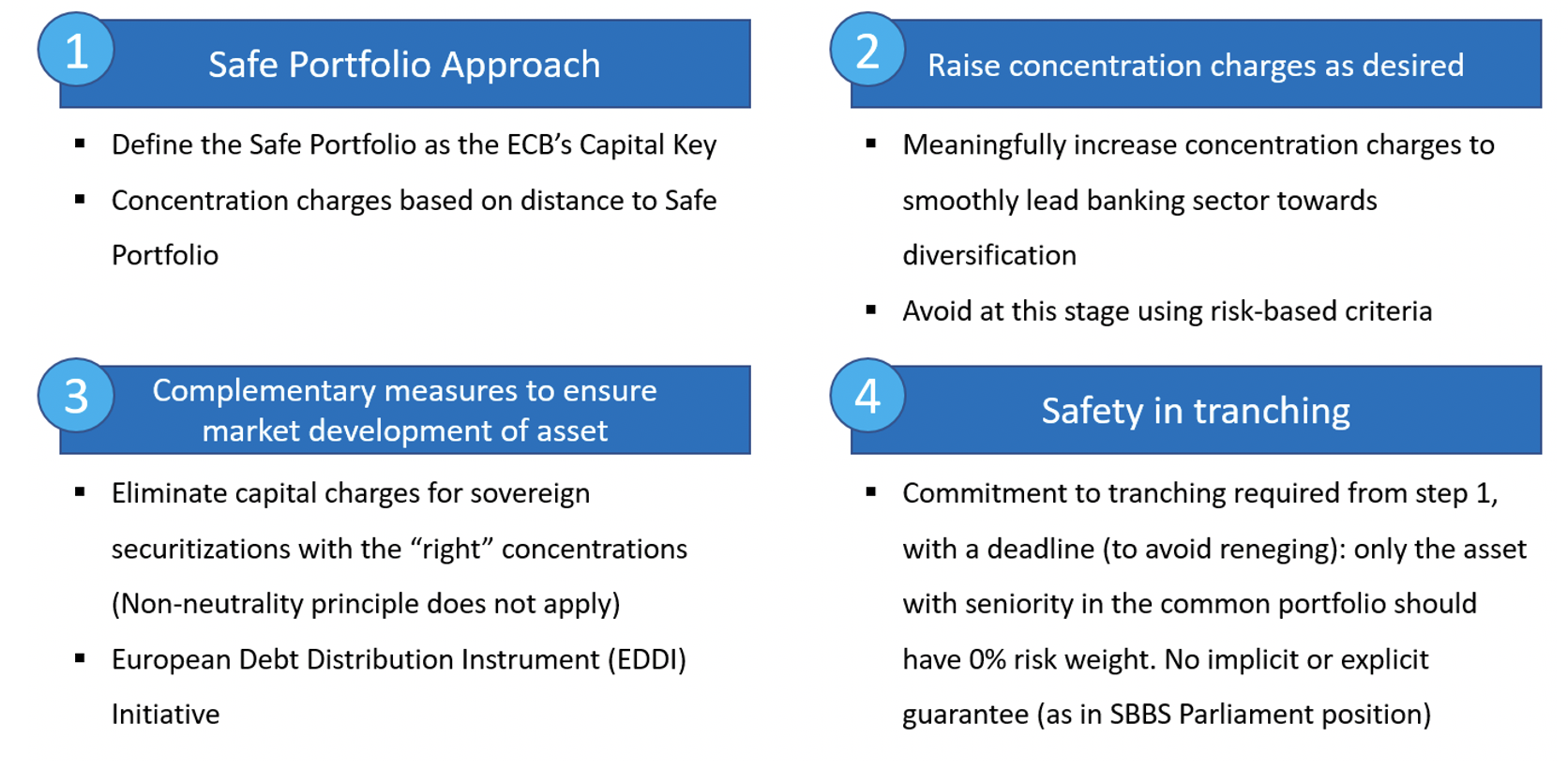

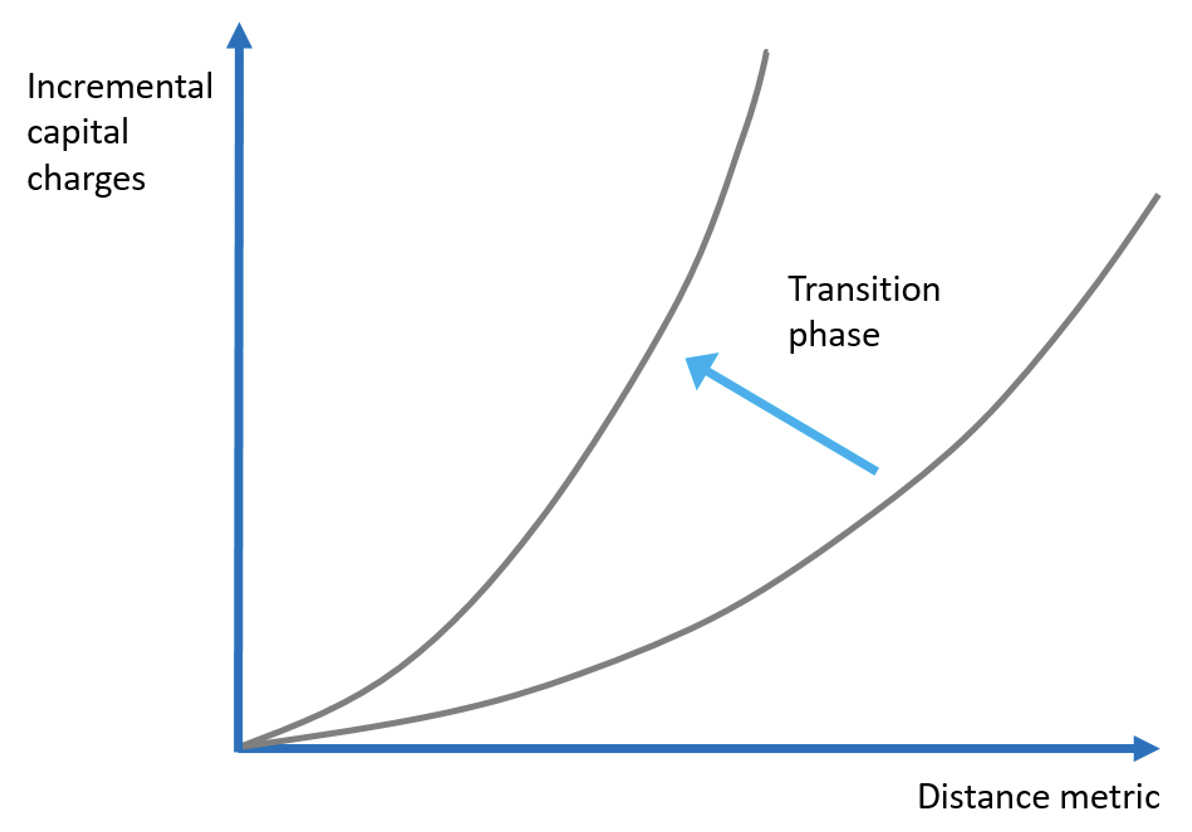

Two proposals to resurrect the Banking Union: The Safe Portfolio Approach and SRB+ | VOX, CEPR Policy Portal

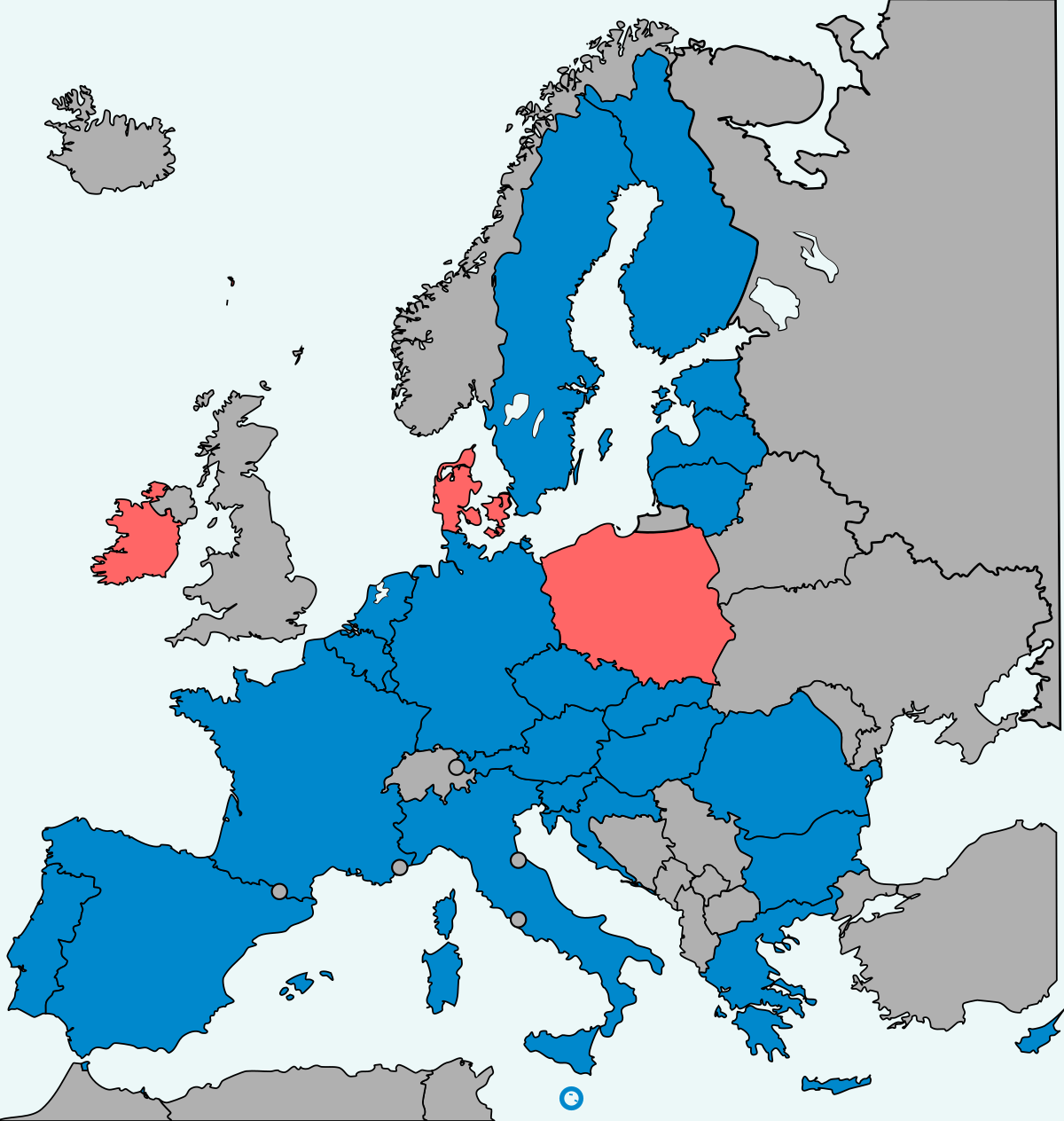

EUStateAid Commission 🇪🇺 approves 2022-2027 regional aid map for Sweden 🇸🇪⬇️ https://t.co/hM9VsJLjZm https://t.co/h4f3UtHxv6 - EU Agenda

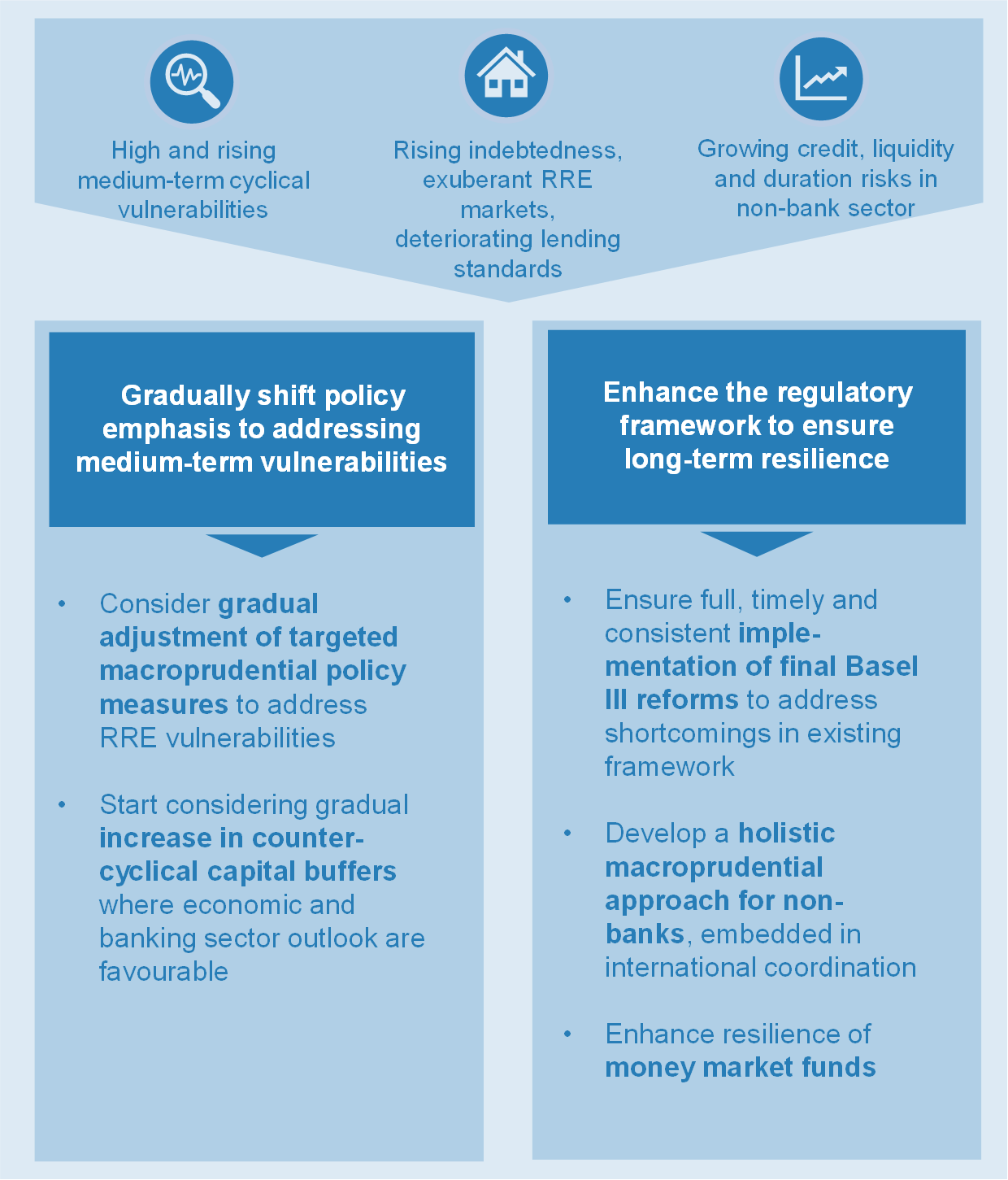

📢 Call for evidence on macroprudential rules for banks to limit systemic risk. What can we learn from the Covid-19 shock? Are the current rules fit to address emerging risks such as

Two proposals to resurrect the Banking Union: The Safe Portfolio Approach and SRB+ | VOX, CEPR Policy Portal